My first year of investing was full of red numbers, emotional dips, and late-night portfolio checks. But it also taught me the lessons that still guide me today: patience, preparation, and the value of “learning money”.

People often say: “I wish I’d started investing earlier.”

Yes, technically that’s true for me as well. More years in the market would probably have meant more returns today. But here’s the catch: I only started investing when I was financially and emotionally ready to do so. Before that, I didn’t have enough money to lock away for the long term. And without the right preparation, I probably would’ve quit the first time things went south.

Because make no mistake, they did. And not just “oops, I lost a fiver” south. More like: “why is my app bleeding red and why do I keep checking it at 2am” south.

The Long Runway Before Takeoff

My first step into investing wasn’t opening a brokerage account. It was listening.

One of my best friends recommended the Dutch podcast Jong Beleggen. The premise was simple but brilliant: a young entrepreneur had just sold his company, pocketed a big sum of money, and decided to invest part of it in the stock market. Each week, he and a co-host discussed the basics of investing, their portfolios, and how the swings made them feel.

For more than a year, I listened religiously. It was my crash course in what investing looks like in real life. Not just numbers on a screen, but the emotions that come with them. Also, let’s be honest: hearing someone else talk about losing thousands makes your future €500 a month experiment feel a lot less dramatic.

By the time the podcast started covering more niche topics that were only really interesting if you really took the time to elaborately research individual companies, I had already gotten what I needed: a slow, steady introduction to the world I was about to step into.

Looking back, I’m incredibly glad I took my time. Because when I finally started investing in April 2022, the timing was… let’s say, challenging.

Starting Simple, Entering a Storm

My strategy was basic:

- A broad, globally diversified ETF. Like a delicious vanilla ice cream.

- One or two smaller thematic ETFs on the side for personal interest. Like the sprinkles on top.

Nothing wild. Just a foundation and a little flavor. Like plain pizza with a couple of toppings: safe, but tasty enough to keep you coming back.

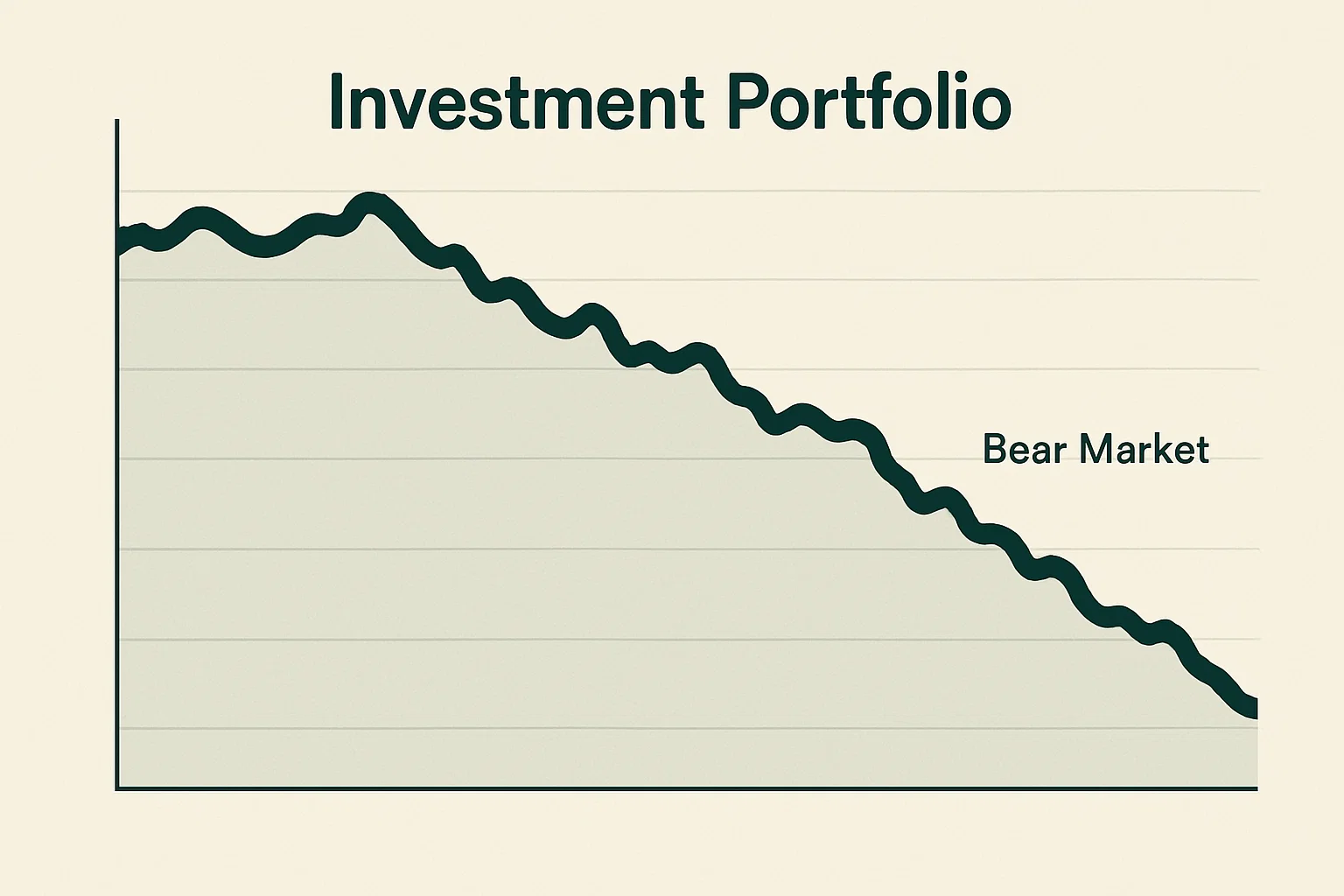

But what I hadn’t prepared for were the emotions. Within weeks of buying my first shares, my portfolio started swinging like a rollercoaster. Three months in, I was down 10%. Two months later, I was up 15%. By the end of the year, I was down 11%.

Basically, my portfolio looked like it had too much Red Bull and couldn’t decide whether it wanted to fly or crash.

The only reason I didn’t panic and sell everything? Three things kept me grounded:

- I invested money I wouldn’t need for years. So instead of panicking, I could shrug and say, “Guess this is future-me’s problem.”

- My amounts were still small. Losing a couple hundred euro in value hurt, but it wasn’t like losing rent money.

- Thanks to the podcast, I knew bigger fish were also drowning. If they could stick it out while losing thousands in value in a week, I could handle my fifty-euro swings.

Learning Money

That first year? 100% learning money. I didn’t gain much, but I gained something better: scar tissue.

For over a year, my portfolio kept dipping in and out of the red. Each time, I checked my app, sighed dramatically, and then did… absolutely nothing. Which, funnily enough, was the smartest thing I could’ve done.

Because what I gained wasn’t just returns, it was resilience. I trained my mindset to handle downturns. I built patience. And today, when I see markets drop, I don’t experience extreme panic. I know money can make you do irrational things. I’ve been there before.

And that’s when it clicked: investing isn’t about being a genius, it’s about learning how not to freak out. Wasn’t it Napoleon who once defined a genius as “someone who can do the average thing when everyone else around him is losing his mind”?

It reminded me of my teenage investing lessons from my favorite video game. In that video game, time and patience eventually turned tiny gold coins into castles. Real life is the same, just better graphics, and fewer opportunities to start swinging a sword around without being arrested.

Preparation Pays

It’s tempting to think I “lost” by not starting earlier. But the truth is, I started exactly when I was ready. My savings rate and financial buffers meant I had room to take risk. And the year I spent learning before acting gave me the conviction to stay in, even when the market tested me.

That’s the hidden part of investing most people don’t talk about: it’s not just about when you start, it’s about being prepared. Preparation is what keeps you from rage-quitting the market after your first market dip. Because if you start unprepared, the market will chew you up, spit you out, and charge you a transaction fee for the privilege.

Final Thought

My first year of investing wasn’t glamorous. Red numbers. Emotional dips. Too much screen time staring at a graph that looked like a mountain range. But it was also the year I built my foundation:

- I learned that emotions run the show unless you check them.

- I discovered that patience beats panic.

- And I realized that learning money in the form of small losses, the tuition fees of experience, is priceless.

Would I have more money today if I’d started earlier? Probably. But would I have the same mindset and calm? Doubtful.

And in the long run, mindset is the real compounding asset. Because investing isn’t just about money. It’s about training your brain not to throw a tantrum every time the line goes down.

How did you feel the first time your investments went red, and what helped you stick with it?

Many readers share these lessons in their own circles. If this story gave you something, feel free to pass it on!